Estate Planning 101

Estate Planning 101 - Estate Planing Documents

What is Probate and Avoiding Probate

The official definition of the term “probate” is a court proceeding where a will is proved to be valid or invalid. Specifically, probate is the court-supervised process of collecting the recently deceased person’s assets, satisfying their debts, and distributing their assets according to the terms of the will or by the law of intestate succession. Many people aim to avoid probate because it can be costly and time-consuming. Tools like revocable trusts are often the preferred method to avoid probate.

Avoiding probate is a legitimate and desirable objective of many estate plans, but probate avoidance should not be thought of as an end, but rather as a means of achieving other objectives. An estate plan’s goal is to facilitate the transfer of assets after death without the cost and delay of probate while helping the person achieve their overall objectives.

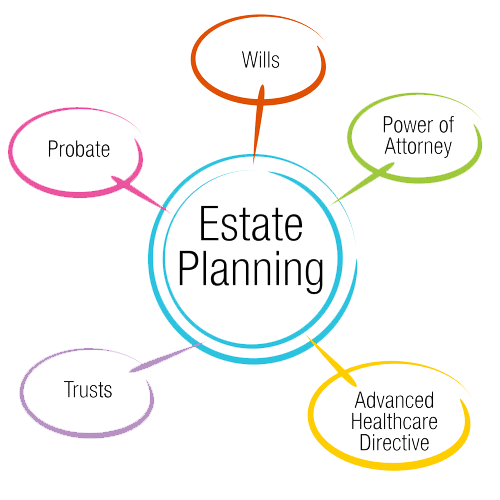

Estate Planning Documents

An estate plan includes key documents that outline a person’s wishes for their property and health care if they become unable to make decisions or pass away. Here’s a breakdown of the main documents often included in an estate plan:

1. Last Will & Testament

- A Last Will & Testament states who will receive a person’s assets after they die. It also names an executor who will manage the distribution process. A will can also specify guardians for minor children. A Pour-over will. A pour-over will is used in conjunction with a revocable trust and generally directs the executor to transfer any of the decedent’s assets owned at death to a trust, with the assets to be distributed according to the trust provisions.

2. Revocable Trust

- A revocable trust allows a person to place their assets in a trust managed by a trustee, who could even be the person creating the trust. They can change or terminate the trust during their lifetime. Unlike a will, a revocable trust doesn’t go through probate, keeping the distribution private. The trust is funded by transferring assets to the trust.

This means, for example, officially changing the title on properties and accounts ownership from John Doe to the “John Doe Revocable Trust, John Doe, Trustee.” Where real property is transferred to a trust, a new deed reflecting the trust as the property owner will be necessary.

Upon the death of a person, a trust can distribute the assets within the trust to the named beneficiaries of the trust, similar to the distribution of assets under a will. A pour-over will can be used in conjunction with a revocable trust to ensure that any assets not transferred to the trust during the grantor’s lifetime are transferred upon the grantor’s death.

3. Healthcare Power of Attorney

- A Healthcare POA allows someone to choose a trusted person to make medical decisions for them if they can’t do so. The chosen person, called an agent, will act based on the wishes of the person issuing the POA.

4. Property Power of Attorney

- A Property POA allows someone to appoint an agent to manage financial matters if they become unable to do so. This agent can handle things like paying bills, managing investments, and other financial tasks.

5. Advance Healthcare Directive (Living Will)

- A Living Will lets a person outline their wishes for end-of-life medical care. It specifies whether they want life-prolonging treatments if they have a terminal condition and can’t communicate.

6. Certificate of Trust

- A Certificate of Trust is for third parties to certify a trust is in place without having to provide of a copy of the actual trust. This contains a summary of key provisions from the Trust but does not reveal other personal details.

These documents together make up an estate plan, helping ensure that a person’s wishes are followed and their loved ones are cared for according to their desires. AGandhi Law can help you create a full suite of Estate Planning documents to help you and your family rest assured and be more confident that your loved ones will be cared for in accordance to your wishes.