Will vs. Trust

Will vs. Revocable Trust

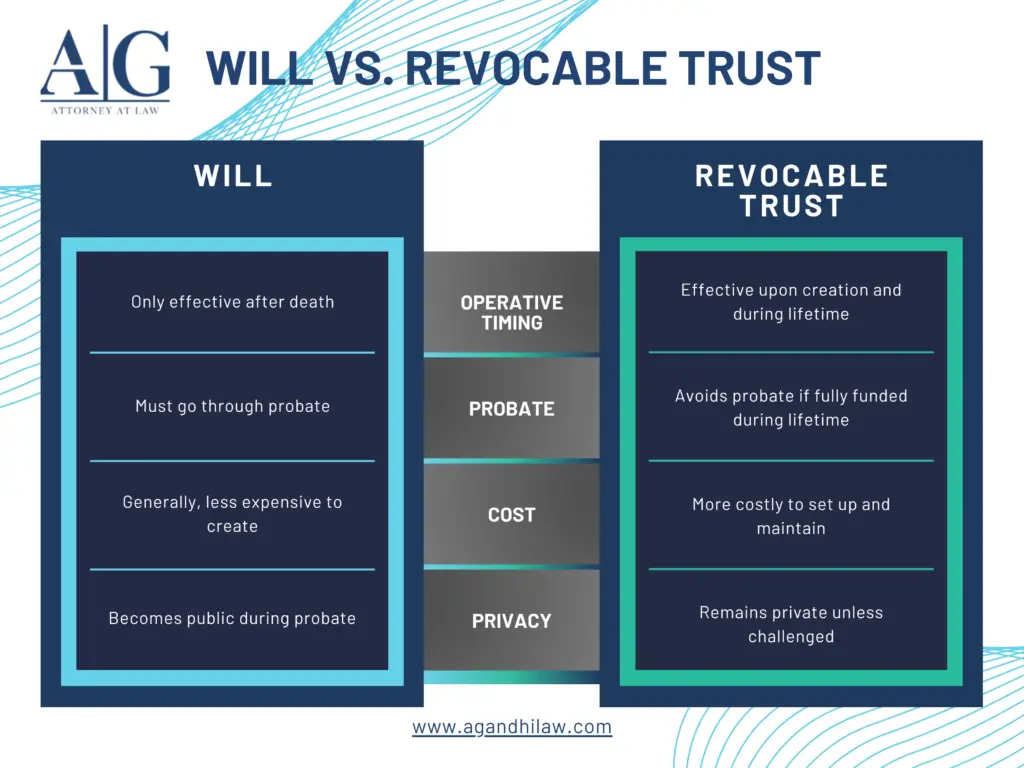

Choosing between a will-based or revocable trust-based estate plan depends on various factors such as the complexity of the probate process, a client’s financial situation, and personal preferences. Both a will and a revocable trust are tools for managing assets, but they operate differently in key areas like probate, privacy, and administrative ease. Both can help ensure your possessions go to the right people but there are some key differences.

What is a Will?

A will is a legal document that explains how you want your assets to be distributed when you die. It only takes effect after you pass away. You can also use a will to name someone to manage your estate (called an executor), create trusts for your children or others, and name guardians for your children.

One downside of a will is that it has to go through a legal process called probate. Probate can take a long time and might cost money. This process is public, so anyone can see what’s in your will, which may not be ideal for everyone.

What is a Revocable Trust?

A revocable trust is a legal document where you place your assets during your lifetime. You manage the trust as long as you are alive and capable. You can change or cancel the trust whenever you like. After you die, the person you pick (called a trustee) manages and distributes your assets to your beneficiaries according to the trust.

One benefit of a revocable trust is that it avoids probate. This means your assets are distributed more quickly and privately. However, setting up a trust can be more expensive and complicated than creating a will. You also have to move your assets into the trust while you’re alive, which takes effort.

Choosing between a Will and a Revocable Trust.

Choosing between a will and a revocable trust depends on your needs. A will might be easier and cheaper to set up. If you don’t mind the probate process or don’t have complex assets, a will might be enough. On the other hand, if you want privacy, to avoid probate, or plan for what happens if you become unable to manage your affairs, a revocable trust might be a better option.

In short, both options are useful, but the best choice depends on your personal situation. You can also combine them by having a trust and a simple will to cover any assets not placed in the trust. It’s always helpful to talk to an expert to decide what’s right for you.